Retained Earnings Definition & Example

Retained Earnings Definition & Example

If shareholders do not need immediate cash, they may vote to retain corporate earnings to avoid income tax. As retained earnings increase, the stock value of the company also increases. This allows shareholders to later sell the company at a higher price or they can simply withdraw dividends in the future. Corporations must publish a quarterly income statement that details their costs and revenue, including taxes and interest, for that period. The balance shown on the statement is the corporation’s net income for the quarter and is considered accumulated returned earnings.

The owners of a corporation (shareholders) pay tax on dividends, not retained earnings. As described above, all owners have equity – a share in the ownership of the business. In most businesses, the owners must pay tax on the equity created by the business each year in the form of profits. As a business owner, you must pay taxes on your share of this increase in yearly increase in equity, even you don’t take it out of the business. Both of these methods attempt to measure the return management generated on the profits it plowed back into the business.

Return on investment (ROI) is a financial ratio used to calculate the benefit an investor will receive in relation to their investment cost. It is most commonly measured as net income divided by the original capital cost of the investment. Capital expenditures retained earnings statement of cash flows refer to funds that are used by a company for the purchase, improvement, or maintenance of long-term assets to improve the efficiency or capacity of the company. Long-term assets are usually physical and have a useful life of more than one accounting period.

Assume your small business generated $30,000 in net income during an accounting period. Also, assume you had $15,000 in depreciation expense and added $5,000 to net working capital. You would calculate $30,000 plus $15,000 minus $5,000 to get $40,000 in net cash provided by operating activities. Net income is the base number a business uses to determine its net cash provided by operating activities.

Since retained earnings is a long-term measure, it’s really not very handy on its own and must be used within the context of the company’s more recent results as well as its future prospects. So to summarize, cash is often a product of retained earnings, but it’s not where most of those retained earnings will end up over time as companies reinvest earnings in the business. Below is a short video explanation to help you understand the importance of retained earnings from an accounting perspective.

Retained earningsare the cumulative net earnings or profit of a company after paying dividends. Retained earnings are the net earnings after dividends that are available for reinvestment back into the company or to pay down debt. Since they represent a company’s remainder of earnings not paid out in dividends, they are often referred to as retained surplus.

Retained earnings are business profits that can be used for investing or paying down business debts. They are cumulative earnings that represent what is leftover after you have paid expenses and dividends to your business’s shareholders or owners. Retained earnings are also known as retained capital or accumulated earnings. This video shows how the Retained Earnings (and Accumulated Deficit) account changes over time. Retained Earnings is a Stockholders’ Equity account that represents the accumulated profits since the company’s formation, minus any dividends that were distributed to the company’s shareholders.

Do Retained Earnings Affect Net Cash Provided by Operating Activities?

Small corporations also use retained earnings to purchase equipment and other assets as well as pay off company debts and liabilities. The purpose of the income statement is to provide the financial earnings performance of the entity over a specific period of time. It is also referred to as a profit and loss statement or earnings statement. The Income Statement formatis revenues, expenses, and profits (or losses) of an entity over a specified period of time.

- Small corporations also use retained earnings to purchase equipment and other assets as well as pay off company debts and liabilities.

- Life can be hard for some companies – such as those in manufacturing – that have to spend a large chunk of profits on new plants and equipment just to maintain existing operations.

- A company’s board of directors may appropriate some or all of the company’s retained earnings when it wants to restrict dividend distributions to shareholders.

- You can compare your company’s retained earnings from one accounting period to another.

- Partners can take money out of the partnership from theirdistributive share account.

- Retained earnings are the amount the Company has accumulated over the years from the net income after paying dividends to the shareholders.

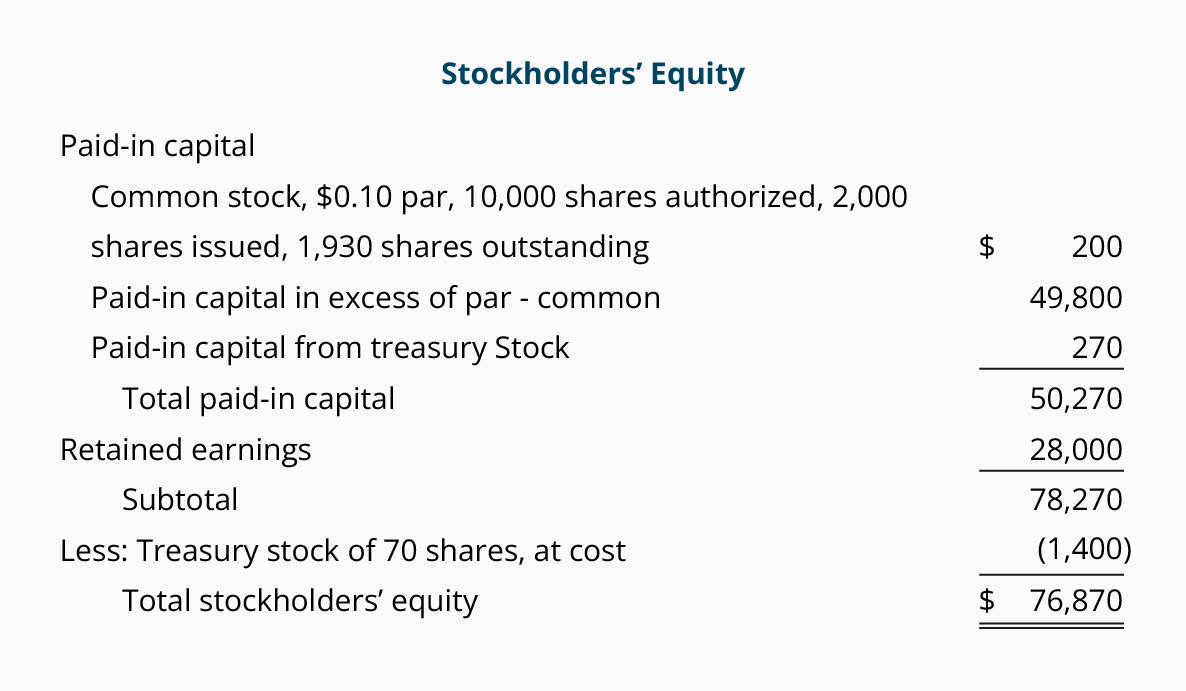

The Statement of Retained Earnings, or Statement of Owner’s Equity, is an important part of your accounting process. Retained earnings represent the amount of net income or profit left in the company after dividends are paid out to stockholders. You can find your business’s previous retained earnings on your business balance sheet or statement of retained earnings.

The Row over Business Rates

Profits are also referred to as net income or the “bottom line” because profits are reported at the bottom of the income statement. Some analysts call these “accounting profits” because they include non-cash accounting entries such as depreciation and amortization.

In addition, the income summary account, which is an account used to summarize temporary account balances before shifting the net balance elsewhere, is also a temporary account. Permanent accounts are those that appear on the balance sheet, such as asset, liability, and equity accounts. If a company would like to keep its flow of financial aid, it would be a good choice to pay dividends to continue attracting investors. However, companies are not required to pay dividends, so the company could keep the earnings and use them to expand. On the balance sheet, retained earnings appear under the “Equity” section.

Essentially, retained earnings and the inverse, accumulated deficit, are a running tally of a company’s historical profits kept after paying out dividends. It’s reported in a company’s quarterly 10-Q and annual 10-K SEC filings, under the “stockholders equity” section of the balance sheet. Retained earnings are the amount the Company has accumulated over the years from the net income after paying dividends to the shareholders.

They may either use the money to invest further in the firm or they can convert the retained earnings into a dividend that is paid out to shareholders. Let’s assume, for instance, that Company X ends its fiscal year with $10 million in retained income on the books. Now let’s say Company X reports a net income of $2 million at the end of the year but then pays out $1 million in dividends to shareholders.

Since the company’s earnings per share in 2012 is $1.35, we know the $5.50 in retained earnings produced $1.10 in additional income https://www.bookstime.com/statement-of-retained-earnings-example for 2012. Company A’s management earned a return of 20% ($1.10 divided by $5.50) in 2012 on the $5.50 a share in retained earnings.

Your company’s net income can be found on your income statement or profit and loss statement. If you have shareholders, dividends paid is the amount that you pay them. Retained earnings refer to the amount of net income that a business has after it has paid out dividends to its shareholders.

Apple and General Mills are both established companies with long track records of consistent profitability, as their massive running tally of retained earnings shows. However, newer companies that may be spending more than they are bringing in to develop a market or expand their business may carry a negative retained-earnings number. The three financial statements are the income statement, the balance sheet, and the statement of cash flows. These three core statements are intricately linked to each other and this guide will explain how they all fit together.

Deixe uma resposta

Quer participar da discussão?Sinta-se livre para contribuir!